Pune-based pet care startup Wiggles, which has raised a funding of over $6.5 Mn to date, is struggling for survival. The startup has only two months of runway remaining and most of its employees have left as it has not paid salaries for over a year.

It finds itself on the brink of a collapse due to an aggressive expansion spree gone wrong, rising losses, and failure to secure fresh funding.

Before we delve into the struggles of Wiggles, let’s first take a look at its journey so far.

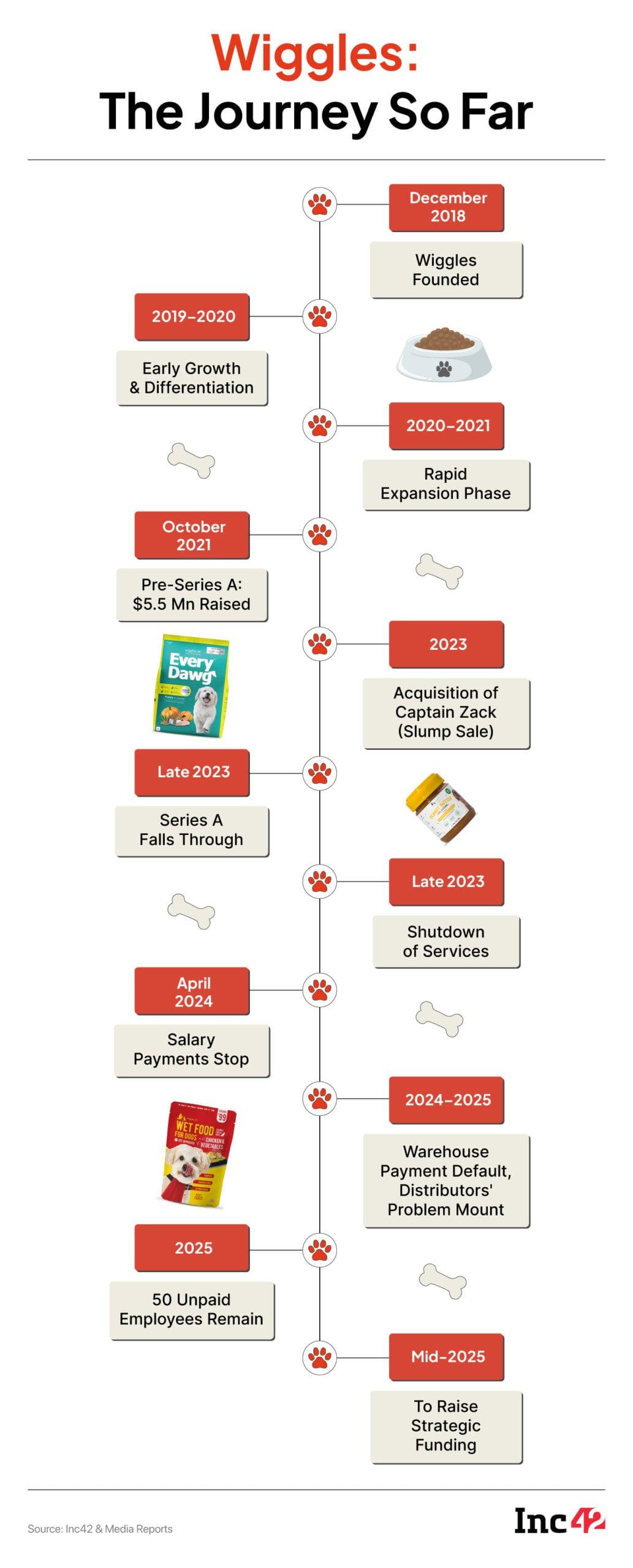

Founded in December 2018 by Anushka Iyer and her father Raj Venkataramani, Wiggles started as a local pet care startup in Pune. Iyer, a longtime volunteer with Blue Cross, envisioned an integrated pet care ecosystem offering services like home visit by veterinarians, groomers, and a product line that included pet food, treats, medicines, and supplements.

In its early days, Wiggles tried setting itself apart from the traditional aggregator model by employing full-time veterinarians and groomers for better quality control. The business grew rapidly, particularly during the Covid-19 pandemic, when pet ownership surged, coupled with a rapid growth in the ecommerce sector.

Riding this momentum, the startup expanded operations to two more cities – Mumbai and Hyderabad – and introduced a comprehensive suite of offerings. This included the launch of a pet boarding facility in Pune and the establishment of a veterinary hospital.

It also launched pet care products with 40 SKUs, spanning food, treats, supplements, and over-the-counter medications. Wiggles adopted an omnichannel approach, selling the products via its own website, ecommerce platforms and offline distribution network.

Wiggles’ Expansion SpreeAfter witnessing high growth during the pandemic, the startup raised $5.5 Mn in its pre-Series A funding round in October 2021. The round was led by Anthill Ventures, with participation from Panthera Peak Capital and angel investors like Varun Alagh of Mamaearth, Nikhil Bhandarkar of Ubiquity Capital, among others. Flush with funds, it set on an aggressive expansion plan.

Wiggles acquired rival Captain Zack in 2023. It was following the playbook that most of the startups adopted during that period – focus on rapid revenue growth, profits would follow.

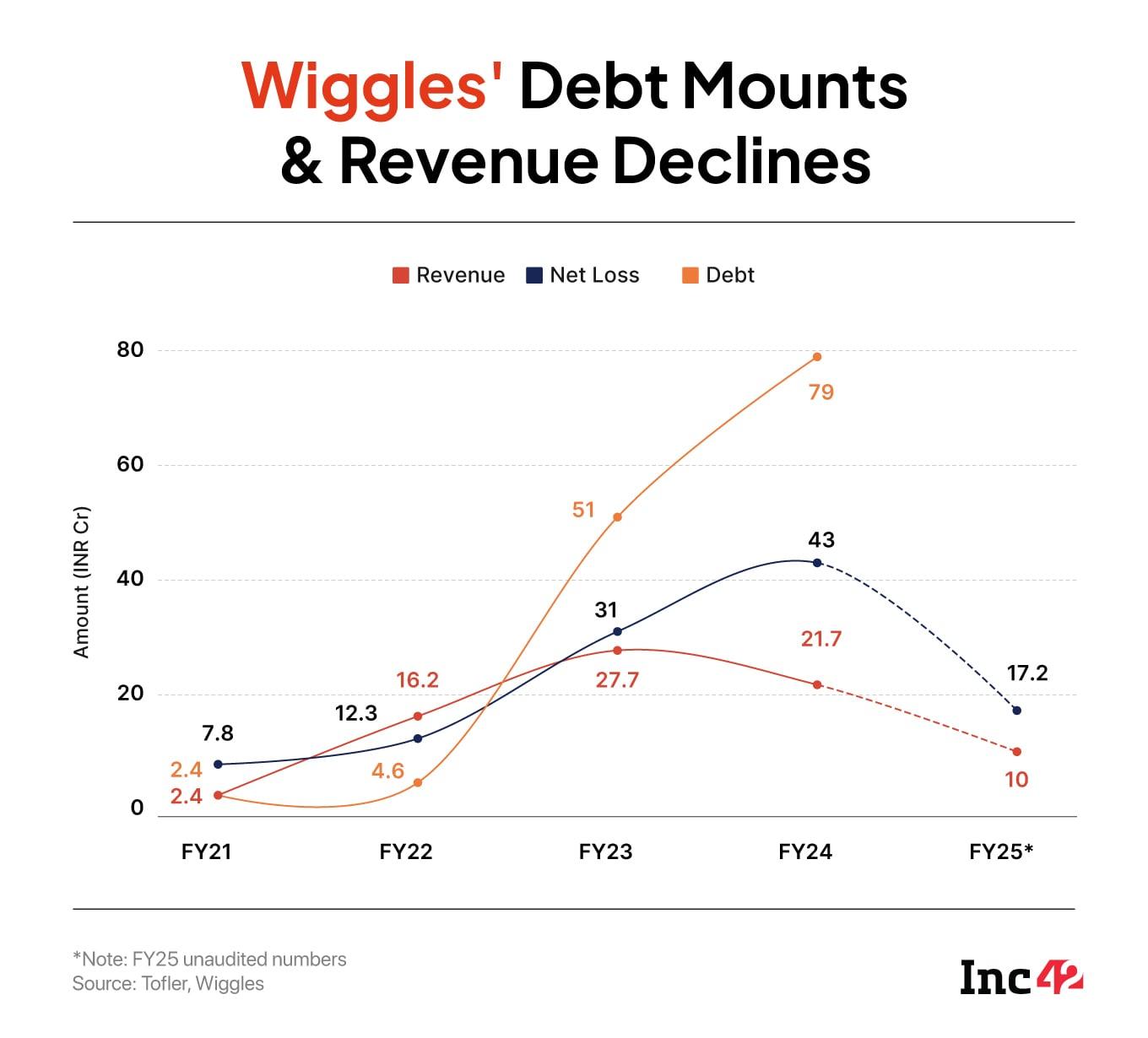

Consequently, Wiggles’ operating revenue zoomed from INR 3.9 Cr in FY21 to INR 16.2 Cr in FY22 and INR 27.7 Cr in FY23. In line with this, its expenses rose. Total expenditure grew from INR 11.8 Cr in FY21 to INR 58.2 Cr in FY23. As a result, net loss surged from INR 7.8 Cr in FY21 to INR 31 Cr in FY23.

Amid this, Wiggles began talks to close a $15 Mn to $20 Mn Series A funding round in late 2023. However, this round didn’t materialise. Sources told Inc42 that investors wanted a path to profitability, which the startup wasn’t able to show.

However, cofounder Venkataramani told Inc42 that Wiggles had an acquisition offer as well as a funding offer, which it didn’t take. “I also had a term sheet on a table, but I instead chose to focus on the sustainability of the business,” he said.

In order to cut down losses and cash burn, Wiggles decided to exit the services business and focus only on its product business.

“Services were good. Pet parents valued them, but they were very capex heavy… The cash burn was extremely high. As the funding was paused, we chose to exit services at that point, which led to the closure of our pet boarding facility and pet clinic,” the cofounder said.

This led to Wiggles operating revenue declining from INR 27 Cr in FY23 to INR 21.6 Cr in FY24. But net loss kept rising. Its loss rose 38.7% YoY to INR 43 Cr in FY24, while the expenses rose 11.3% to INR 64.8 Cr.

After shutting its services business, Wiggles approached investors for a new fundraise. But investors’ priority had changed by then and they wanted profitability, said Venkataramani.

This failure to raise capital gave a crushing blow to the pet care startup.

Unhappy Employees & DistributorsDue to the cash crunch, Wiggles stopped paying salaries to its employees from April 2024, the sources said. It had over 270 employees at its peak in May 2023, of which only 10 are with the startup now.

As per its EPFO data, Wiggles paid provident fund (PF) for about 235 employees in January 2024, which reduced to 172 employees in April that year. Since then, it has not made PF deposits for its employees.

“It began in April last year. Salaries didn’t arrive. At first, there were murmurs of funding delays, a temporary hiccup. Leadership assured employees that disbursements would be made within 10 days,” a former employee told Inc42.

However, employees started leaving en masse as the wait kept getting longer and the startup failed to disburse salaries for even a single month after April 2024.

Acknowledging that Wiggles has not paid salaries to employees, Venkataramani said it owes about INR 3 Cr to INR 4 Cr in wages. “Yes, it’s true that salaries, including the PF, have not been paid since last year due to a working capital crunch,” the cofounder said.

“We are extremely grateful to these team members who have stood by us during difficult times. Of course, everyone has their threshold, and we understand that. But those who have remained are the foundational pillars upon which this company has been built. Currently, we have around 50 employees. While many have voluntarily deferred their salaries, we continue to pay our sales team wherever possible,” he added.

As per Venkataramani, about 35% of the current workforce comprises the sales team.

Meanwhile, amid the capital crunch, Wiggles streamlined its distributor network and decreased the number of distributors to 24 from 180 at its peak, Venkataramani said. While this was done to improve visibility into tertiary sales, the distributors have also been hit hard by the startup’s problems.

The sources said that some of the distributors are saddled with Wiggles’ unsold inventory worth lakhs of rupees, which it has not taken back. The reason behind this is that the pet care startup doesn’t have a warehousing facility to store the goods, as it failed to pay rent of INR 1 Cr for the warehouse to its operator Flomic Logistics.

But, the cofounder said that the distributors in question have not presented the required certificate of destruction. Discontinuing underperforming SKUs and optimising the portfolio is a standard part of a startup’s evolution. “In such cases, unsold inventory is handled responsibly through established industry practices, including certified destruction, where necessary,” he said.

Can Wiggles Get A Lifeline?Going ahead, Wiggles’ survival depends on funds infusion. As of now, the startup has moved back to a smaller office space, and has only two months of runway left coupled with the debt of INR 79 Cr at the end of FY24, as per its MCA filings. Besides, its revenue tumbled to just INR 10 Cr in FY25.

Wiggles cofounders said that they are close to securing a deal from two strategic investors. They believe that the funding would put the startup back on track.

Venkataramani said that the startup managed to reduce its loss by 60% in FY25 but didn’t disclose the exact number. Wiggles has set a target of achieving breakeven in the next six months and intends to remain entirely product focussed, with its services business now permanently shut.

However, it is pertinent to note that the cofounders of Wiggles also started a new D2C spiritual platform ‘Seetara’, which sells rudraksha and other spiritual items, during 2023-24. This raises concerns if their focus is now divided between two ventures.

Venkataramani, however, rejected this argument, saying Seetara is operated by a family member and a friend’s son, and that he and Iyer are only non-executive directors. He added that the platform has only four employees and has operationally broken even. The investment of the Wiggles’ cofounder in Seetara is under INR 4 Lakh.

Meanwhile, Wiggles’ fate hangs in the balance. Data from Semrush shows that Captain Zack sees fewer than 2,000 monthly users and Wiggles.in receives less than 15,000 visits a month, mostly for its educational blog content. As such, if Wiggles secures the funding it expects to get, it will offer the startup the lifeline it needs to reset and rebuild.

Edited by Rai Vinaykumar

The post Inside Wiggles’ Woes: Cash Crunch, Employee Exodus & An Uncertain Future appeared first on Inc42 Media.

You may also like

Mystery over King Charles and Prince Harry 'leak' as questions asked about Sussex motive

I've tried dozens of hair masks– this is the one that actually repairs damage

Your legal rights if you aren't offered an in-person GP appointment

School Assembly Headlines for July 15: Top national, international, sports and business updates

Steven Bartlett and Chicken Shop Date host honoured in new Time100 list