The 2025 festive season saw a new frenzy grip urban India – on-demand and instant domestic help apps. Demand for cleaning services is already at its peak during Diwali and quick service apps cashed in big time, clocking a record 8 Lakh transactions in October as of writing.

But as the festive lights dim, a key question remains – is this a new revolution or just a seasonal rush?

Big Bang Diwali: This festive season served as the first major stress test for the nascent quick services segment, and the results were telling. The surge in demand, largely attributed to the seasonal shortage of regular domestic help, validated the core value proposition of these platforms – verified, on-demand professionals at a moment’s notice.

Race Heats Up: Urban Company’s “Insta Help” saw orders double month-on-month, while Snabbit’s transaction volumes jumped 100% in October. Pronto, another well-funded player, is also aggressively expanding, targeting a workforce of 10,000 professionals. This competition is also fuelling a war for talent on the ground, with platforms vying to attract and retain workers with competitive pay and benefits.

The Unit Economics Problem: Despite robust volume growth, the quick services segment faces problems of its own. With average order values hovering around a modest INR 180-200, margins are razor-thin after accounting for worker pay and logistics. Like their quick commerce counterparts, these platforms are currently prioritising market creation and customer acquisition over unit economics, a strategy heavily subsidised by venture capital.

For now, the real test is whether these platforms can sustain their growth without deep discounts and despite the regulatory complexities of the gig economy. As the festive dust settles, can these platforms convert seasonal users into high-frequency loyalists without burning billions in the process? Let’s find out…

From The Editor’s Desk Lenskart Suits Up For IPO

Lenskart Suits Up For IPO - Lenskart has filed its RHP, with the IPO opening on October 31 and closing on November 4. The fresh issue is INR 2,150 Cr, while the OFS portion has been trimmed slightly by 47 Lakh shares. The IPO valuation may be reduced to $8 Bn from $9 Bn.

- The company plans to expand its physical retail footprint with 620 new stores by FY29, invest in tech and cloud infrastructure (INR 213.4 Cr), and allocate INR 320 Cr for brand marketing, along with funds for acquisitions and general corporate purposes.

- Lenskart returned to profitability in Q1 FY26, posting a net profit of INR 61.2 Cr versus a loss of INR 25.7 Cr a year ago, with operating revenue growing 25% YoY to INR 1,894.5 Cr.

PharmEasy Swallows A Bitter Pill

PharmEasy Swallows A Bitter Pill - The troubled healthtech startup has sold a 10% stake in its listed subsidiary, Thyrocare, for INR 667.7 Cr. With this, PharmEasy’s stake in the diagnostics chain has now been reduced to 60.93%.

- The epharmacy major has been grappling with shrinking revenues, losses, leadership churn and mounting credit payments. PharmEasy even pledged its stake in Thyrocare last month to secure INR 1,700 Cr in debt to repay pending loans.

- The stake sale is not a strategic divestment but a survival move. It underscores PharmEasy’s desperate need for cash to service its debt and stay afloat, even if it means selling off parts of its most valuable asset.

- After much ado, the EV major’s board has finally approved a proposal to raise up to INR 1,500 Cr via a mix of equity shares and convertible securities. The proposed fundraise will be subject to shareholder approval and other regulatory clearances.

- The potential fundraise stands in contrast to the company’s claims (in its Q1 FY26 shareholder letter) that it was “well funded for this year and the next” and would not need more capital for operational needs.

- This comes as Ola Electric faces significant challenges, including a tanking stock price (down 38% YTD), stagnant revenues, a declining market share, intensifying competition from legacy rivals, and mounting losses.

A Slow Funding Week

A Slow Funding Week - Even as India revelled in the festive spirit, startup funding took a heavy hit last week. Indian startups raised a mere $312.5 Mn between October 20 and October 26, down 57% from the $737.4 Mn raised in the preceding week.

- Partly to blame for this was the low deal count. Only three deals materialised last week. SaaS major Uniphore cornered the lion’s share of the funding at $260 Mn, followed by Unify Apps’ $50 Mn Series B round.

- Prominent global and domestic investors, including Nvidia, Westbridge Capital, and Rainmatter, participated in the funding rounds of the week. No funding deals were reported at the seed stage last week.

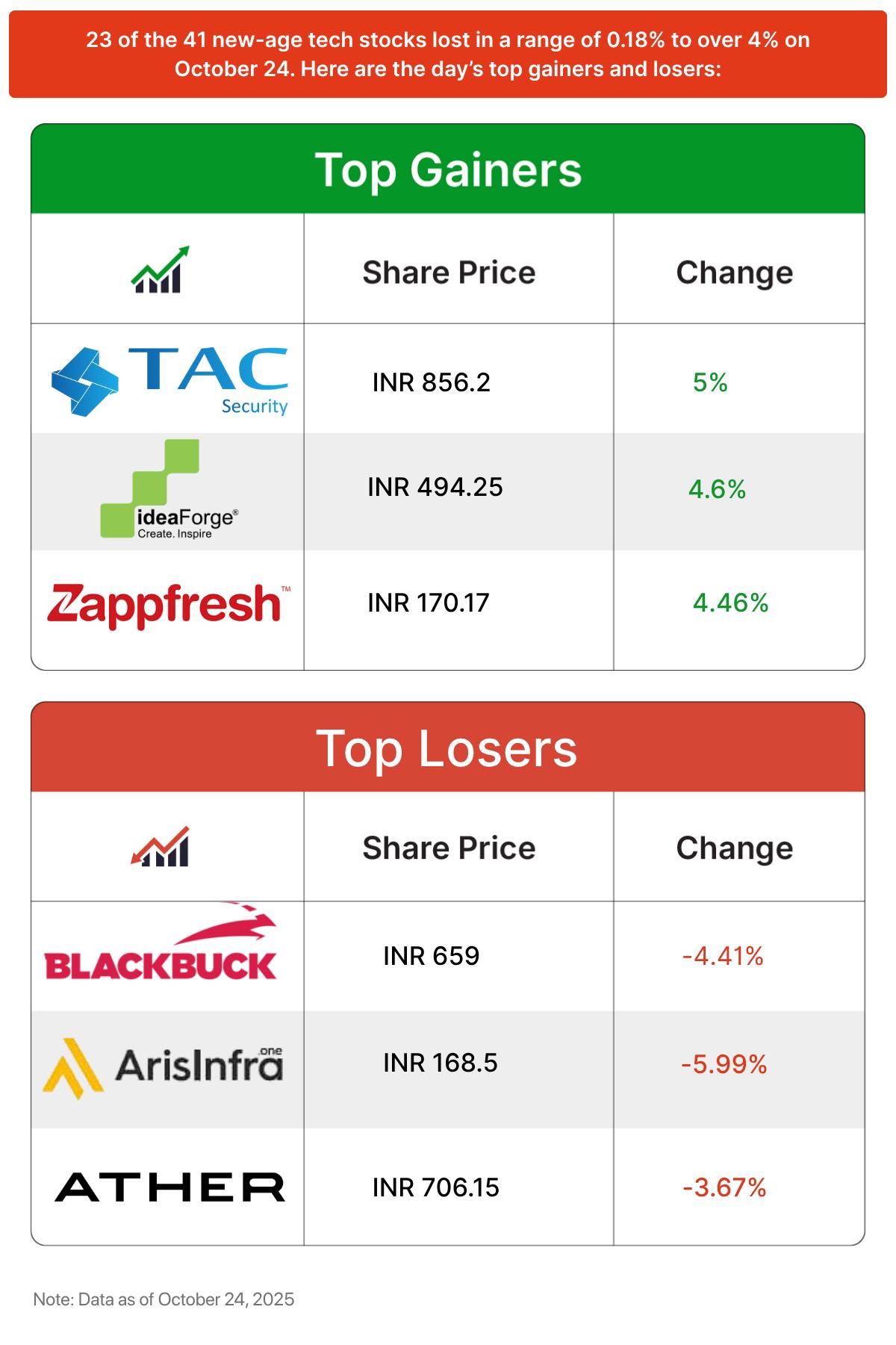

- Of the 41 startup stocks under Inc42’s coverage, 24 ended last week in the green. The overall market capitalisation of these companies dipped slightly to $110.93 Bn from $113.17 Bn in the preceding week.

- Specific tailwinds drove the gainers. Drone tech companies like DroneAcharya (up 8.74%) and ideaForge (up 4.33%) rallied on the back of the Centre’s INR 79K Cr defence procurement approval. TAC Infosec surged after reporting profitable H1 results.

- The direction of the market this week will be influenced by the upcoming US Fed’s meeting on interest rates, earnings results of major startups and the ongoing India-US trade negotiations.

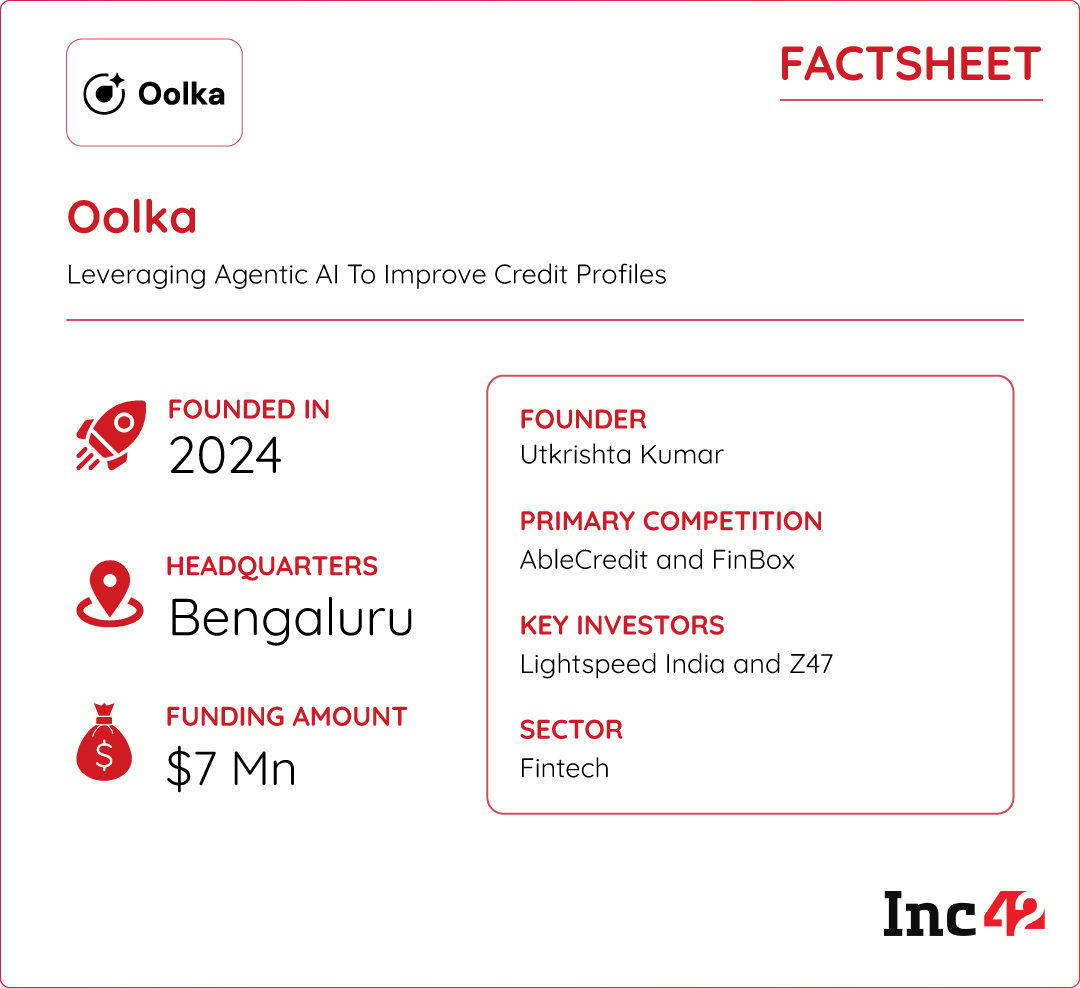

While millions of Indians have gained access to digital credit, many still struggle with the complexities of managing their financial health. They often lack the visibility and guidance needed to navigate loan repayments and improve their credit scores, leaving them vulnerable to high interest rates and errors in their credit reports.

Finance-Savvy AI Buddy: Enter Oolka, a fintech startup that offers a proprietary AI bot, Dhruva, for credit management. The AI agent helps users track their credit scores, offers advice, and takes active measures to improve a user’s credit health. It also operates a marketplace, offering products such as credit cards and loans to customers.

From Insight To Action: Oolka’s AI agents can scan credit reports to flag issues and opportunities. These bots can then, with a user’s consent, initiate negotiations with the lender to lower the interest rate. Its AI agents can also spot errors in a credit report, like an incorrectly marked unpaid loan, and automatically log a ticket with the credit bureau to get it rectified on the user’s behalf.

The Road Ahead: Backed by names such as Lightspeed and Z47, Oolka claims to have processed over INR 100 Cr in repayments and is nearing $1 Mn in annual recurring revenue in FY25. Going forward, it aims to morph into a distribution centre for cross-selling different financial products.

As agentic AI becomes the next frontier in fintech, can Oolka truly democratise credit health for every Indian?

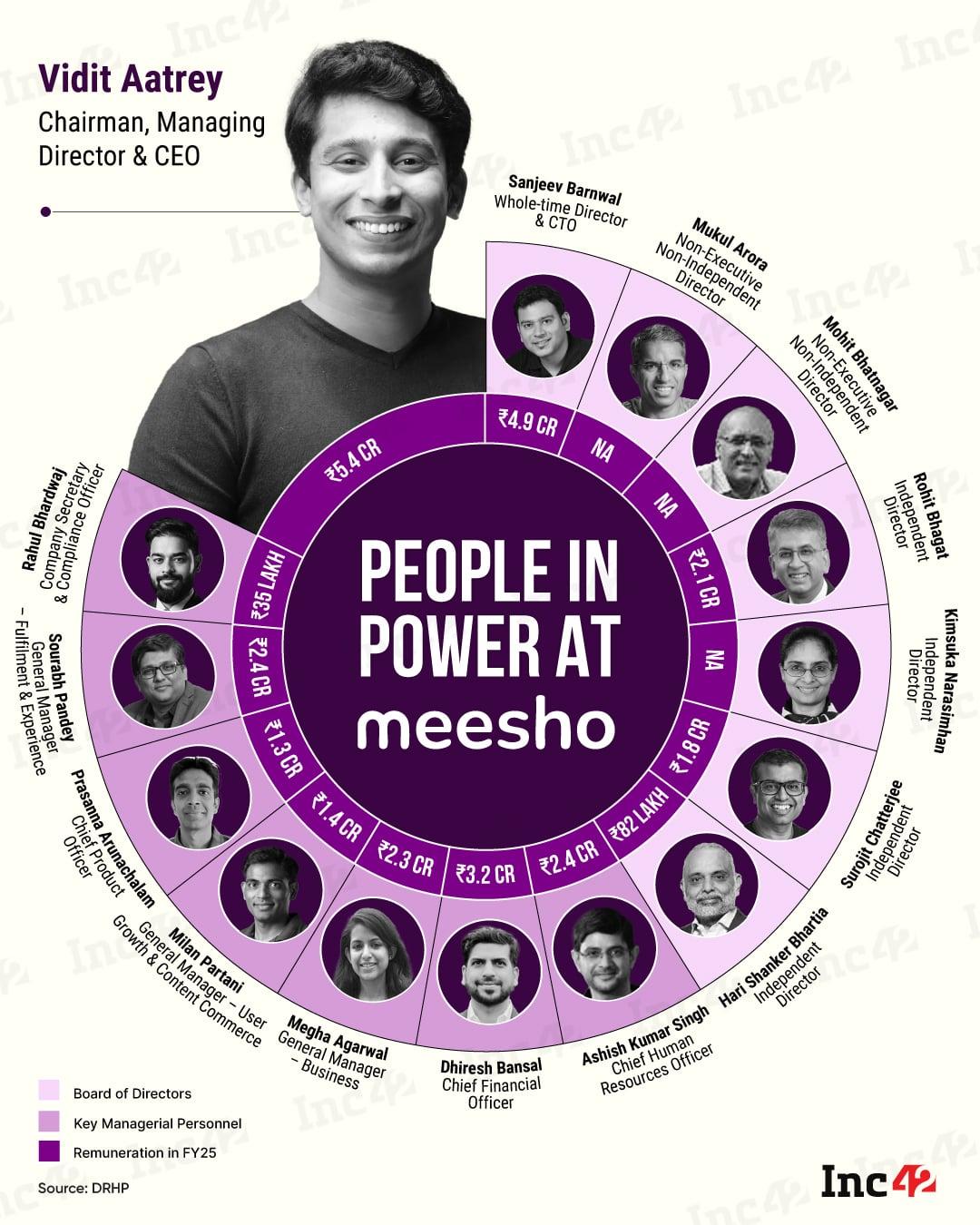

As Meesho gears up for its much-anticipated $1 Bn IPO, the ecommerce unicorn’s leadership and boardroom dynamics are now in focus. So, who is at the helm of affairs at the SoftBank-backed giant?

The post The ‘Instant Help’ Frenzy, PharmEasy’s Bitter Pill & More appeared first on Inc42 Media.

You may also like

Liverpool duo slammed 'terrible' as Alan Shearer calls out Arne Slot stars

India and Japan have major role to play in realising peace, stability in Indo-Pacific: Japanese FM (Ld)

Huge brawl breaks out at Mexican Grand Prix as punches thrown and man kicked

Visiting UAE Commander briefed on 'Operation Sindoor'

How 'old money' thinks differently? CA's financial lessons on why most Indians fail to build 'generational wealth'