At the start of the year, we knew that the IPO momentum was going to be super strong among Indian startups. Some of the most noted companies in the country — PhonePe, Urban Company, OYO, Pine Labs, Zepto and others — are on the cusp of going public and naturally, there was a lot of confidence among investors about exits and maturity in the startup ecosystem.

But in the past month or so, there is also a new wave of caution. Under the President Donald Trump administration in the US, global trade has been shaken to quite some extent, and markets are reacting every day to new developments and changes in trade tariffs.

Many believe this is a temporary pain that should not deter the IPO parade in India, but it will have some impact on new IPOs. The first sign of this was perhaps on display this week as Urban Company finalised its plans for the IPO and received its board approval.

But the final issue size might be well below previous expectations.

For one, the next set of IPOs are likely to be much smaller than the ones we have seen in the past four years. More and more companies will be looking to take a rational approach to fundraising in this current environment, and companies with minimal exposure to global trade winds will be the ones that will cash in.

Take for example, Urban Company, which was bullish about a mega IPO in late 2024 but has had to rejig its plans in the past two months. As we reported this week, the company’s board has approved raising via a fresh issue in its IPO, in addition to an offer-for-sale component.

Incidentally, earlier this year, when the startup, reports suggested that Urban Company was planning to file its draft papers for an INR 3,000 Cr IPO ($300 Mn+) before the end of March. While that timeline has since changed, clearly, so has the company’s appetite for fundraise from public markets.

It’s not just Urban Company — even EV maker Ather Energy is cutting its IPO size by at least $50 Mn (about INR 430 Cr) from its earlier target of $400 Mn (about INR 3,460 Cr) amid the ongoing volatility in the Indian and the global stock markets.

The market turmoil might also result in Ather seeking a lower valuation for the IPO, however, as of now, Urban Company’s valuation for the IPO remains under wraps.

The New Look Of Urban CompanyFounded in 2014 by Abhiraj Singh Bhal, Raghav Chandra and Varun Khaitan, Urban Company has been in the news recently for its quick commerce transition with the launch of. Under it, the startup offers services such as cleaning, cooking, washing and more, connecting users to professionals in their area.

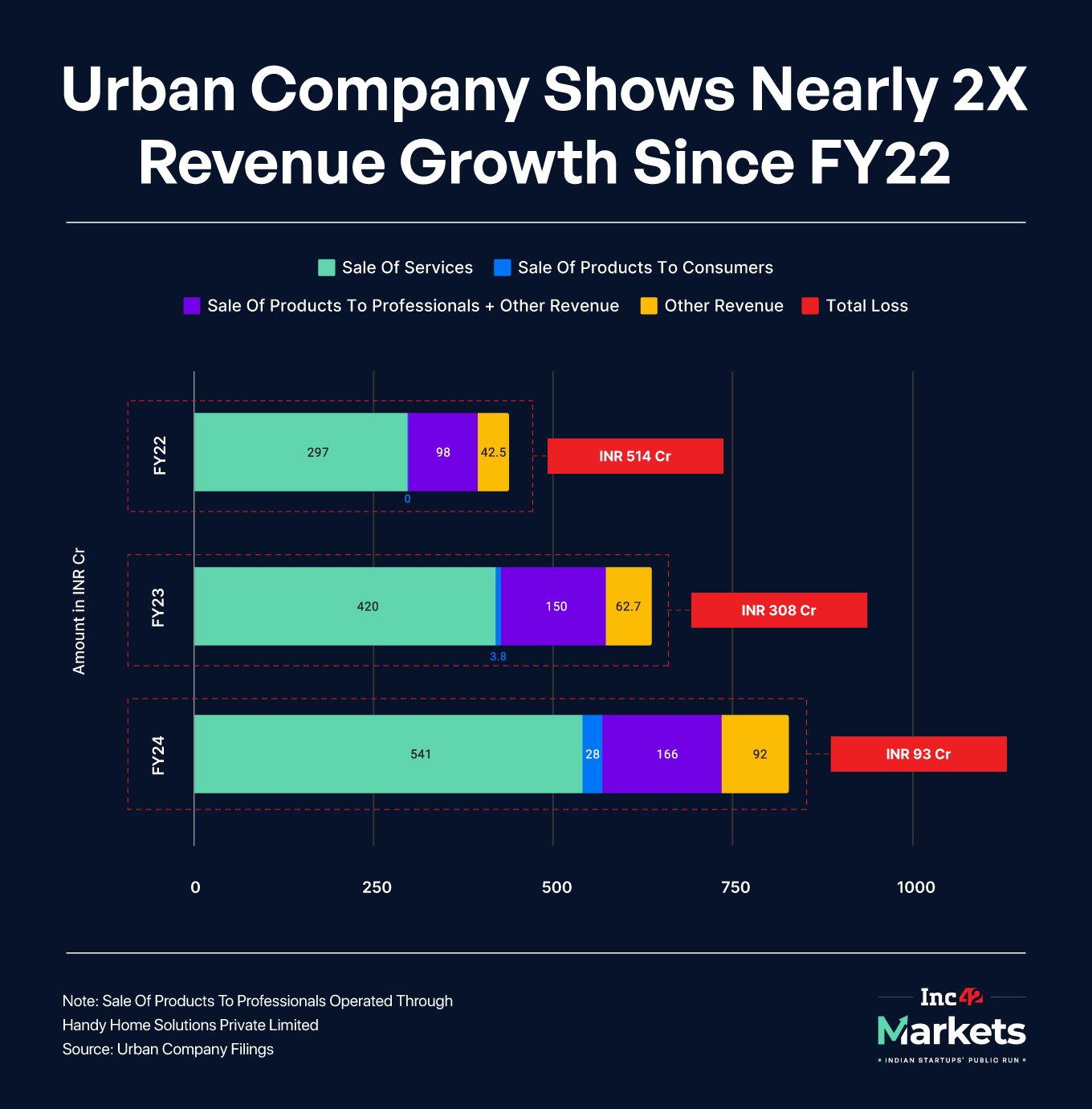

Urban Company’s revenue model has changed quite a bit in the past two years. In fact, the revenue has nearly doubled since the end of FY22, and losses have come down significantly. It saw a near to INR 827 Cr in FY24 and narrowed its loss before tax to INR 93 Cr.

The company has gone beyond the commission-based model it started with. Today, it operates a marketplace for professionals and even these gig workers have to pay a subscription fee to remain on the platform. In addition to this, there is a commission charged on every job, plus of course revenue collected from consumers.

With the IPO on the horizon, revenue from services is a key focus for Urban Company, along with revenue from products sold to professionals for fulfilling these services. But it’s also adding other pieces such as InstaHelp, its take on quick commerce and venturing into consumer brands.

No Room For Loss-Making IPOs?“There is no real precedent for a model like Urban Company in the public markets. While most investors and institutions would be familiar with Zomato or Swiggy’s model, they may not quite be in sync with how Urban Company pulls off the operations and the many moving pieces,” said a Bengaluru-based VC fund partner.

According to him, not having a counterpart in the market is often a disadvantage for companies looking to list, as most public markets investors like to have benchmarks for revenue and profitability. Even among the Indian listed companies and new-age tech stocks, there is no precedent for a model like Urban Company.

This is undoubtedly a challenge for the company, similar to what Paytm faced when it listed, and it will have to spend considerable time and effort to convey the model to the investor base.

The other big issue is sustaining profitability even as rules for gig work and part-time professionals change and evolve in the long run. The likes of Zomato and Swiggy have diversified quite a bit and while any changes in gig worker rules will naturally impact them severely, Urban Company is more heavily reliant on gig workers for revenue and business momentum.

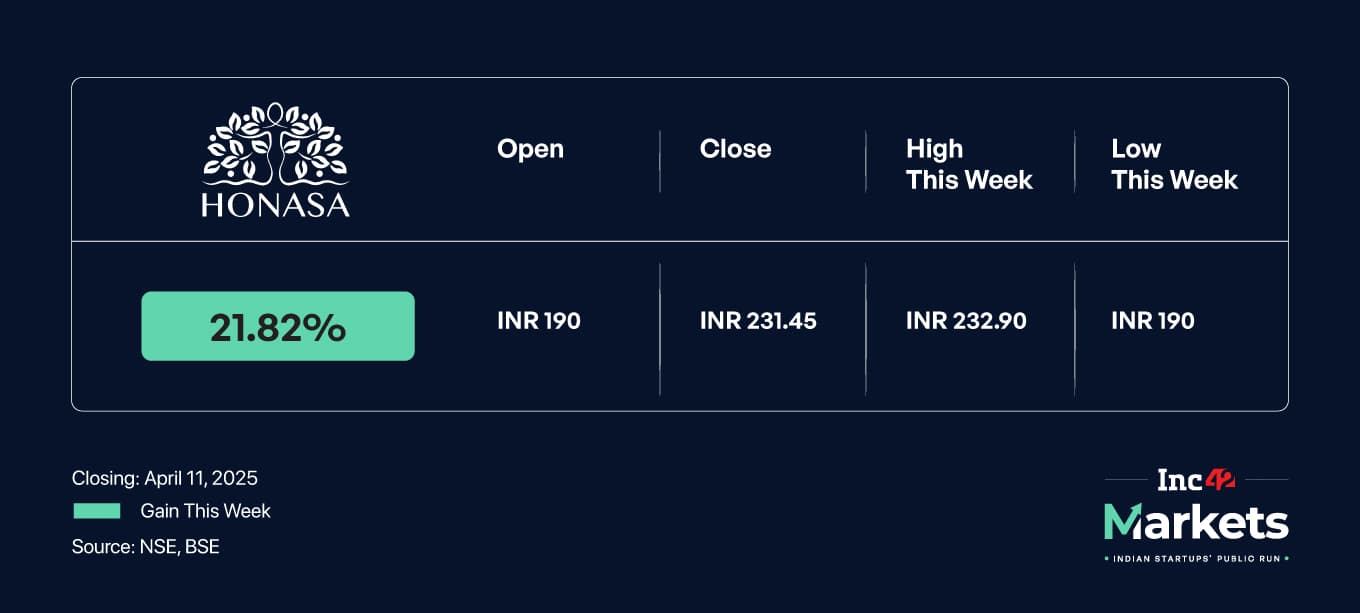

It is perhaps for this reason that Urban Company is to be mulling a D2C play, launching beauty, wellness, and personal care products for consumers, which could put it in the same league as Nykaa or Honasa, and therefore give investors a better view of its financial roadmap.

The IPO size cut is a strong message that the public market investors are no longer willing to pay 10x or 20x revenue multiples for loss-making startups.

Even though cofounder and CEO Bhal claimed that Urban Company hit profit before tax in the first quarter of FY25, long-term profitability will be key for the company as it hits the public markets trail. This is perhaps the biggest hurdle for Urban Company as it goes through the IPO litmus test.

Stock In Focus: HonasaHonasa Consumer, the parent of Mamaearth, showed signs of resilience after opening the week at its 52-week low. The stock rebounded on Friday after four sessions of decline, gaining 5.72% on April 11, 2025, outperforming its sector.

In terms of performance metrics, Honasa outperformed the retail sector by 5.35% this week, but it remains below the 5-day, 100-day, and 200-day moving averages, indicating that this may be a temporary bump for the stock.

Incidentally, this past week, Honasa earned a against RSM General Trading LLC in the UAE. A Dubai court ruled in favour of Honasa, overturning a previous ruling which ordered the company to pay AED 25 Mn as compensation. This court case has been an overhang on Honasa for the past year or so, and settling this would allow the company to press ahead with its international business.

Over the past month, Honasa has seen a 7.38% gain in its stock price compared to the 1.68% bump for the overall Sensex. However, the Varun Alagh and Ghazal Alagh-led company’s year-to-date stock performance remains well below par at -8.82%, compared to the Sensex’s decline of -3.57%.

Honasa was not the only major gainer this past week, as a host of new-age tech stocks bounced back after two weeks of pressure. Here’s a look at the top ten stocks last week:

IPO Watch: Upcoming Issues & More

- Domestic mutual funds increased their stake in Paytm to 13.11% in the fourth quarter from 11.2% in the Q3 FY25, primarily led by Nippon India Mutual Fund and Motilal Oswal Mutual Fund

- Bengaluru-based D2C furniture and mattress startup Wakefit is reportedly looking to make a splash and aims to raise around INR 1,500-2,000 Cr (around $173-231 Mn) through a public offering later this year

- Amazon India backed supermarket retailer More Retail is planning to launch its initial public offering (IPO) next year as it looks to expand its network of supermarket stores in India and cater to the quick commerce boom

- Making another stride towards its IPO journey, fintech major Pine Labs has now secured the final approval from the National Company Law Tribunal (NCLT) to merge its Indian and Singapore entities and redomicile to India

The post appeared first on .

You may also like

Centre planning Rs 10L cr investment to rewire highways, NE roads will match US standards: Gadkari

Assam gearing up to celebrate Rongali Bihu

Alexander Volkanovski becomes two-time UFC champion with thrilling win over Diego Lopes

US court temporarily restores F-1 status of international student in key legal breakthrough

President Droupadi Murmu Honors Jallianwala Bagh Martyrs on 104th Anniversary